State Employees Credit Union

Finding a financial partner that truly gets what you need, especially when you are part of the state's workforce or have family ties there, can make a real difference in your daily life and for your long-term plans. It is more than just a place to keep your money; it is a place where you can feel understood and supported. This is exactly the kind of connection many people look for when they consider where to put their trust with their hard-earned money and future aspirations, and it is something that a place like the State Employees Credit Union in Raleigh, North Carolina, really tries to offer to its people.

When you are thinking about your money, whether it is for everyday spending or bigger life moments, having a group that focuses on you, the member, feels pretty good. It is a different feeling from a regular bank, you know? A credit union, like the State Employees Credit Union, is set up to put its members first, which means any profits usually go back to you in the form of better rates or fewer fees. This approach can make a big impact on your wallet over time, helping your money go further, which is, honestly, a pretty neat thing to consider.

This focus on people means that services and products are often shaped with your specific needs in mind, especially if you are connected to North Carolina's state employment. You might find resources that feel just right for your situation, whether you are just starting out, planning for a family, or getting ready for retirement. It is about building a connection, you see, where your financial well-being is truly a shared goal, and that, in some respects, is a very comforting thought for many people looking for a dependable financial home.

Table of Contents

- What Makes State Employees Credit Union Different?

- How Does State Employees Credit Union Support Your Home Dreams?

- Getting Around with State Employees Credit Union

- Keeping Your Money Safe with State Employees Credit Union

- Who Can Join the State Employees Credit Union Family?

- Are There Any Hiccups with State Employees Credit Union Online Access?

- What if I Need Help with My State Employees Credit Union Accounts?

- Planning for the Future with State Employees Credit Union

What Makes State Employees Credit Union Different?

When you consider a financial place, you often think about who they serve. The State Employees Credit Union has a clear mission: to look after North Carolina employees, their families, and the wider community they live in. This commitment really shows up in how they operate, offering a warm welcome on their Raleigh, North Carolina, home base, where people can sign in, look at important updates, read helpful articles, and check out current rates for borrowing money. It is, you know, a very direct way of showing they are there for you, with information that is pretty easy to find.

For anyone thinking about getting a car, the experience can sometimes feel a bit overwhelming. But with the State Employees Credit Union, those who are eighteen years old or older can approach car shopping with a good feeling of assurance. They offer vehicle loans that come with terms that can be adjusted to fit your situation, and the interest rates are set to be quite reasonable. This means you can find a plan that works for your budget, which is, frankly, a big relief for many people looking to make such a purchase.

And then there is this extra bit of good news: they are, in fact, offering an additional half-percent off the interest rate, which is a pretty sweet deal. This kind of offering can really make a difference in the total cost of a car over time, putting more money back in your pocket. It is a way of saying, "We are here to help you get where you need to go, both literally and financially," and that, in a way, is a very strong message of support from a financial partner like the State Employees Credit Union.

How Does State Employees Credit Union Support Your Home Dreams?

Thinking about your home loan, and whether to change it up, can bring up a lot of questions. You might wonder, "When is the right moment to refinance my home loan?" or "Is this really the best move for my financial situation right now?" These are big questions, and getting good, clear answers is, honestly, a very important step. The State Employees Credit Union has people who specialize in home loans, and they are there to help you sort through all of it. They can talk you through the different options and help you figure out what makes sense for you, which is, basically, a very reassuring service to have when you are making such a big decision.

Their home loan specialists are, you see, like guides. They do not just give you numbers; they explain things in a way that makes sense, helping you understand the whole process from start to finish. This kind of personal guidance can take a lot of the stress out of what might seem like a complicated financial step. It is about making sure you feel good about the choices you are making for your home and your financial future, and that, arguably, is a very valuable part of their service.

Beyond home loans, becoming a member of the State Employees Credit Union opens up a whole range of good things. You can learn more about the various products they offer, the different ways they can help you manage your money, and special deals that are just for North Carolina state employees and those who have retired from state service. These benefits are put in place to give extra support to the people who serve the state, and their families, which is, you know, a very thoughtful approach to financial care.

Getting Around with State Employees Credit Union

Sometimes you need to find a physical location, whether it is a branch to talk to someone in person or an ATM to get some cash. The State Employees Credit Union makes this pretty simple with their branch and ATM locator. You can look for a spot by typing in a full address, a city and state, or just a zip code. Or, if you are out and about, you can use a "my location" search to find the closest one to where you are standing. This means, you know, that finding a convenient place to do your banking is usually pretty straightforward, which is very helpful when you are on the go.

Keeping Your Money Safe with State Employees Credit Union

In this day and age, keeping your money safe from unwanted activity is a top concern for many people. The State Employees Credit Union offers a feature called "Card Lock" that helps with this. You can protect your account by locking your debit card and credit card directly from your mobile device. This means if you misplace a card or see something suspicious, you can quickly put a stop to any transactions, which is, basically, a very comforting level of control to have over your finances, right there in your hand.

Another handy feature for managing your money is "Quick View." This lets you see your account balances without having to log in fully. It is a fast way to get a snapshot of where you stand financially, which is, frankly, very convenient when you just need to check something quickly without going through all the steps of a full login. This kind of quick access is, you know, pretty much what many people appreciate in their day-to-day financial interactions.

When you are ready to make a bigger move, like applying for new accounts or loans, the State Employees Credit Union provides ways to do this, too. You can apply for these things directly, which streamlines the process quite a bit. And for those who use financial management software, you can access your accounts online through programs like Quicken, which helps you keep all your financial information in one place, and that, in a way, is a very useful tool for staying organized.

For more direct communication and access, there is "Member Access." This allows you to get into your accounts online and send messages directly to the credit union through a secure message center. This means you can ask questions, get help, or share information in a protected environment, which is, obviously, a very important part of keeping your personal financial details safe. It is about having a clear and protected line of communication, which many people find to be a very reassuring aspect of their banking relationship.

Who Can Join the State Employees Credit Union Family?

The State Employees Credit Union is pretty specific about who can become a part of their group, but it is also quite broad for those who fit. Membership is open to people who work for the state of North Carolina, those connected to related organizations, and, very importantly, their family members. This means that if you have a parent, a sibling, or even a child who works for the state, you might be able to join, too. It is a way of extending the benefits to a wider circle, which is, in some respects, a very inclusive approach to serving the community.

To figure out if you can join, you just need to look at the specific requirements they have in place. These requirements help make sure that the credit union stays focused on its core group of people while still welcoming those closely tied to them. It is about maintaining that sense of community and shared purpose that often sets credit unions apart, and that, you know, is a very central part of what they do. Checking these requirements is a simple step to see if you can become part of their financial family, which for many, is a very appealing prospect.

Are There Any Hiccups with State Employees Credit Union Online Access?

Sometimes, even with the best intentions, technology can have its moments. There have been instances where people using financial software, like Quicken, have run into issues downloading new transactions or balances from various credit unions, including the State Employees Credit Union in North Carolina, and also from the Pennsylvania State Employees Credit Union and Cross Valley Federal Credit Union. This can be a bit frustrating, you know, when you expect things to just work smoothly, and they do not.

Some members have reported seeing error messages when trying to update their information from the North Carolina State Employees Credit Union. One person mentioned that Quicken seemed to be messing up passwords when trying to update transactions, and they had been trying to fix this problem for a while. It is a situation where, basically, the software is not quite doing what it is supposed to do, and that can be a real headache for someone trying to keep their finances in order, which is, honestly, a very common concern for many users.

There have been conversations among users about these kinds of connection problems, particularly with Quicken for Windows, where people have trouble getting a direct link to their North Carolina State Employees Credit Union accounts. It is a bit like trying to get two pieces of a puzzle to fit, and they just are not quite clicking. These kinds of technical glitches, you know, can be very annoying, especially when you rely on these tools to manage your money efficiently, and that, in a way, is a very valid point of frustration for members.

What if I Need Help with My State Employees Credit Union Accounts?

When these kinds of technical issues pop up, or if you just have a question, reaching out for help is the next logical step. Some members have expressed a desire to find the best way to get a response from the State Employees Credit Union, asking if others who have had success could share the email or text address they used. It is about trying to find that direct line to assistance, which is, frankly, a very natural thing to want when you are facing a problem with your accounts.

One member mentioned having trouble with the web application downloading their North Carolina State Employees Credit Union accounts, getting a message to "swipe to fix" but then finding that Quicken was still having trouble. These sorts of messages can be a bit confusing, you know, leaving you wondering what to do next. It just shows that sometimes, even with modern tools, there can be little bumps in the road, and that, essentially, is why good support is so important.

It is not just a recent thing, either; some people have had problems off and on over the past year trying to download transactions using Express Web Connect from places like the Pennsylvania State Employees Credit Union. This suggests that these kinds of connection issues can be persistent for some users. It is a reminder that while online access is very convenient, there can be moments when you need to be patient or seek out help to get things working as they should, which is, basically, a very realistic part of using technology for your finances.

Planning for the Future with State Employees Credit Union

Looking ahead and getting your affairs in order is a very responsible thing to do, and it can sometimes feel like a big task. For instance, some members have shared that they had their will prepared through the State Employees Credit Union. This kind of service, which helps you plan for what happens to your belongings and wishes, is a very important part of securing your future and that of your loved ones. It is about making sure your intentions are clear, and that, you know, can bring a lot of peace of mind.

For those whose family members are employees, this service was even provided without a cost, which is a very thoughtful benefit. This kind of support shows a real commitment to the well-being of their members and their families, going beyond just everyday banking. It is a way of saying, "We are here to help you with some of life's bigger, more serious matters, too," and that, in a way, is a very comprehensive approach to financial partnership.

The process itself was described as being easy, and people felt comfortable asking as many questions as they needed to. This open and helpful approach means that even something as serious as preparing a will can feel manageable and less intimidating. It is about having someone guide you through the steps, making sure you understand everything, and that, basically, is a very reassuring experience for anyone tackling such an important document for their future.

File:Map of USA showing state names.png

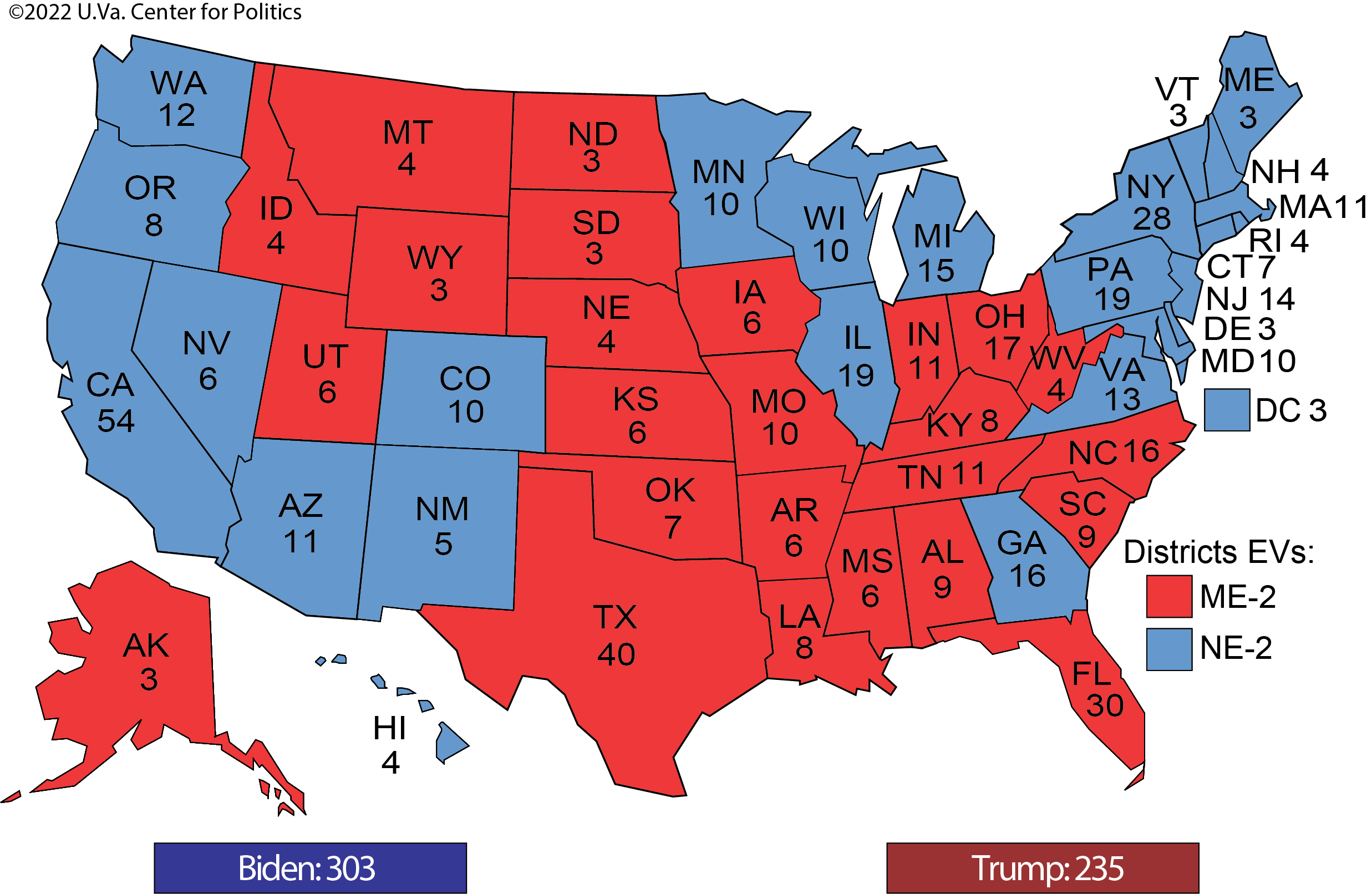

Notes on the State of Politics: March 1, 2023 – Sabato's Crystal Ball

Washington Counties Map | Mappr